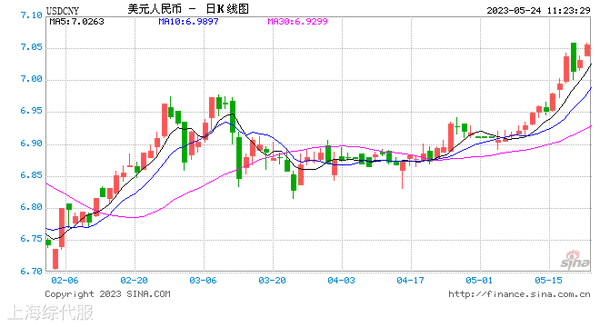

China Foreign Exchange Exchange Center data showed that on May 22, the RMB against the US dollarThe exchange rateThe shore closing price was 7.0304 yuan, down 69 basis points from the previous trading day. Since the first break through “7” on May 17, in just a few trading days, the RMB-USD exchange rate has fallen more than 0.9% on a cumulative basis.

Currently, the RMB exchange rate shows a trend of two-way fluctuation, and the market sentiment is relatively stable. The reduction of the RMB exchange rate brings certain benefits to export companies in the short term. while the RMB exchange rate is expected to remain stable, foreign exchange market transactions are also reasonable. In the long run, the long-term basic stability of the exchange rate is more beneficial for the development of the enterprise.

Export companies said they benefited from the decline in the exchange rate of the RMB. In the deep exchange, the company's products exported to the North American market were settled in dollars, and the reduction in the exchange rate of the RMB helped to increase the exchange earnings of the company. Zhejiang Jint said that the reduction in the exchange rate of the RMB has a positive impact on the company's export business at the current stage.

For export orders, Liu Mingyang, general manager of Yiwu Ouchi Import & Export Co., Ltd. in Zhejiang Province, said, “At present, the orders on hand of the enterprise have been scheduled until June, and the volume of new orders is still increasing.” According to estimates, assuming that a foreign trade enterprises in the end of April to obtain a value of 1 million U.S. dollars of export orders, in May 22 for the settlement of foreign exchange, due to the decline in the exchange rate of the yuan, the enterprise can be an additional profit of about 90,000 yuan, provided that the U.S. dollar-denominated and the transaction price remains unchanged.

Experts say that for large trading enterprises, although the lowering of the RMB exchange rate is a beneficial factor, these enterprises usually lock the exchange rate early to reduce the risk of market volatility and therefore have a smaller impact, while for small and medium-sized enterprises, due to their smaller trade size, it is often not easy to hedge the risk and is more susceptible to the influence of exchange rate volatility. Therefore, the benefits of the lowering of the RMB exchange rate are limited for traders. For enterprises, the basic relative stability of the exchange rate can bring long-term benefits and better development opportunities.

Overall, the reduction of the RMB exchange rate has brought some benefits to export companies in the short term, but for the long-term development of enterprises, the long-term basic stability of the exchange rate is more favorable.As China advances the process of internationalization of the RMB and strengthens monetary cooperation with different trading partners, the stability of the RMB will provide a better development environment and opportunities for enterprises.

Follow customer service WeChat

Follow customer service WeChat