According to Reuters, Bangladesh is currently facing a serious dollar shortage and can’t even pay gas charges, and imports have been delayed over and over again. Bangladesh Petroleum Corporation (BPC) owes six overseas companies more than $300 million in debt, some of which have shipped less than the planned quantity or threatened to stop supply.

Bangladesh is struggling to address power outages that have damaged the clothing export industry (the country’s main business). The agency responsible for power generation and distribution has also warned that it has had to postpone payments due to currency austerity. BPC has asked the government to allow domestic commercial banks to settle membership fees with India in rubles.

According to data from the Bureau of Statistics of Bangladesh (BBS), in fiscal year 2022-2023 Bangladesh’s gross domestic product (GDP) slowed down due to a decline in production in agriculture, manufacturing and services, and GDP growth declined compared to the previous year.

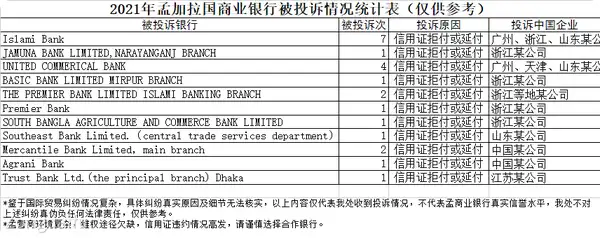

Since the outbreak of the Russian-Ukrainian conflict last year, Bangladesh’s dollar reserves have shrunk by more than a third, and foreign exchange reserves have fallen to $29.8 billion, the lowest point in seven years. Last year, the Embassy of the People’s Republic of Bangladesh’s Economic and Trade Office issued a security risk warning to remind domestic companies to focus on payment methods and dispute settlement terms while signing the agreement, purchase trade insurance, and settle disputes in a timely manner in accordance with the agreement to avoid losses.

Trade risks indicate:There are relevant business exchanges that pay attention to trade risk control (especially receiving payments), be careful about the risk of abandonment and rejection.

Follow customer service WeChat

Follow customer service WeChat